Straight line depreciation formula maths

Merits of Straight Line Method. A book value or.

Straight Line Depreciation Youtube

Worksheets are Depreciation A01 depreciation overview eng final Prepared by el hoss igcse accounting.

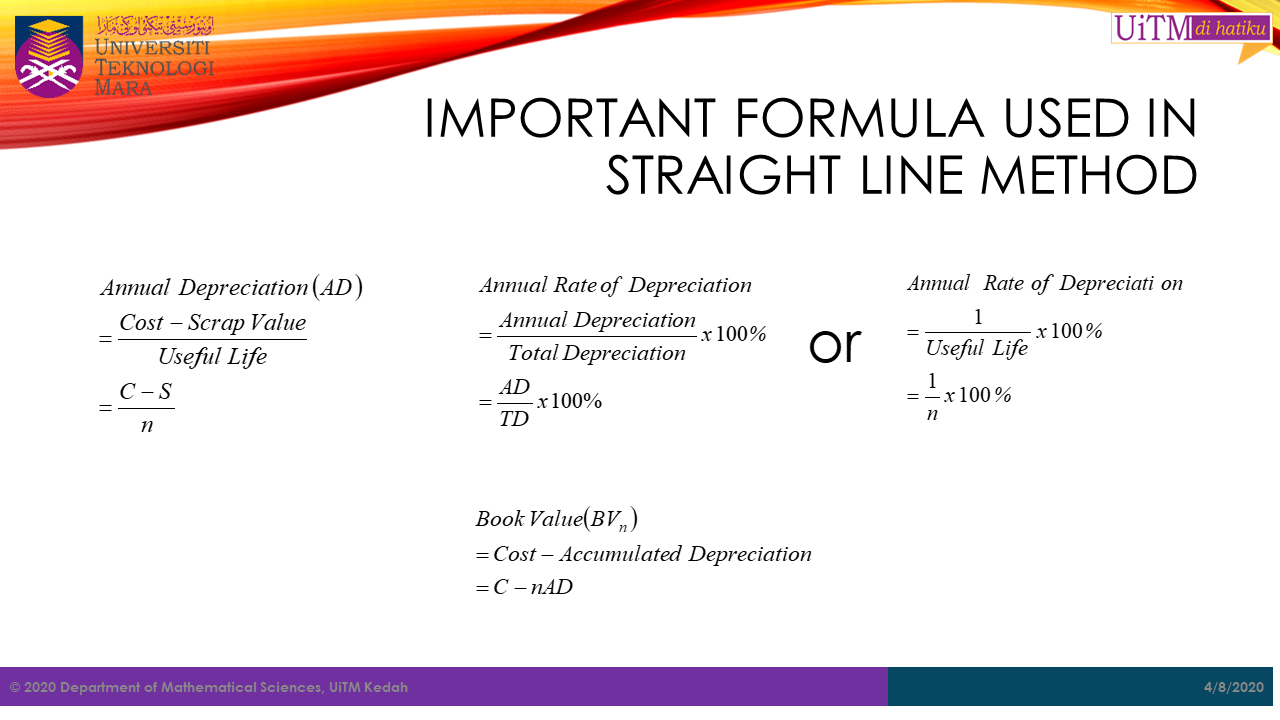

. When Rate of Depreciation is given. Formula for Calculating Depreciation. Straight-line depreciation occurs when the value of the item decreases by the same amount each period.

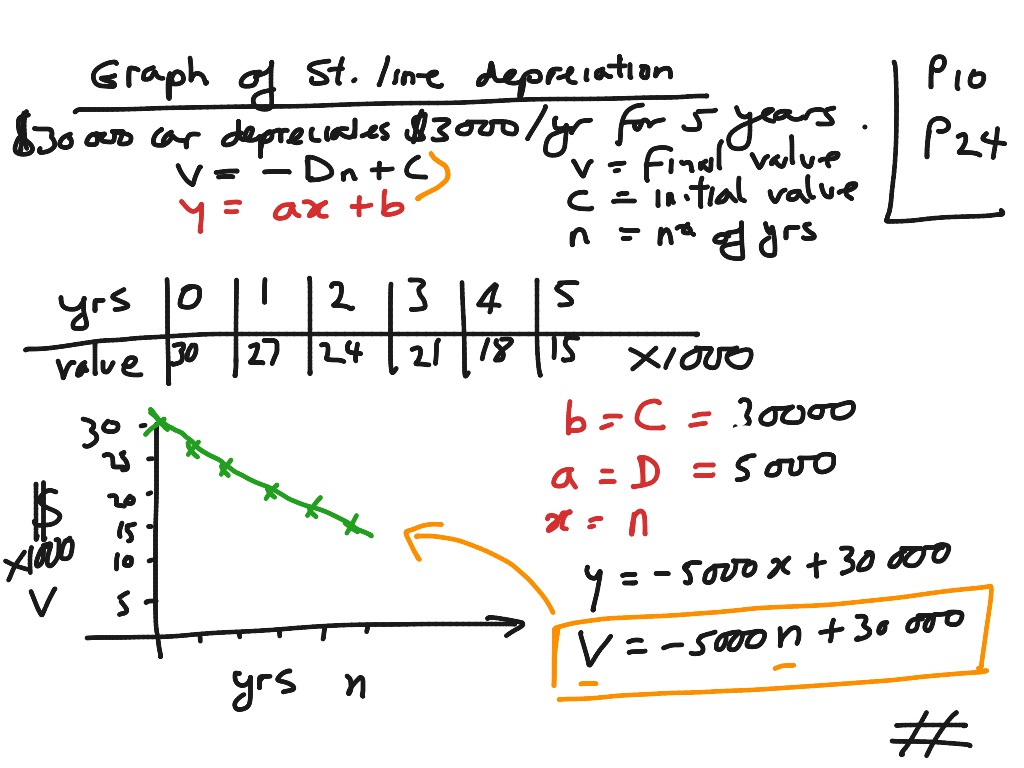

Business Accounting and Bookkeeping. What is straight-line depreciation. Learn how to write a depreciation linear equation given a word problem.

There are primarily 4 different formulas to calculate the depreciation amount. We discuss the slope intercept form of a line to write the straight line depreciatio. It is determined by multiplying the book value of the asset by the straight-line methods rate of depreciation and 2 read more method to calculate the tanks depreciation expense.

Math and Arithmetic. Depreciation refers to the method of accounting which allocates a tangible assets cost over its useful life or life expectancy. In year one you multiply the cost or beginning book value by 50.

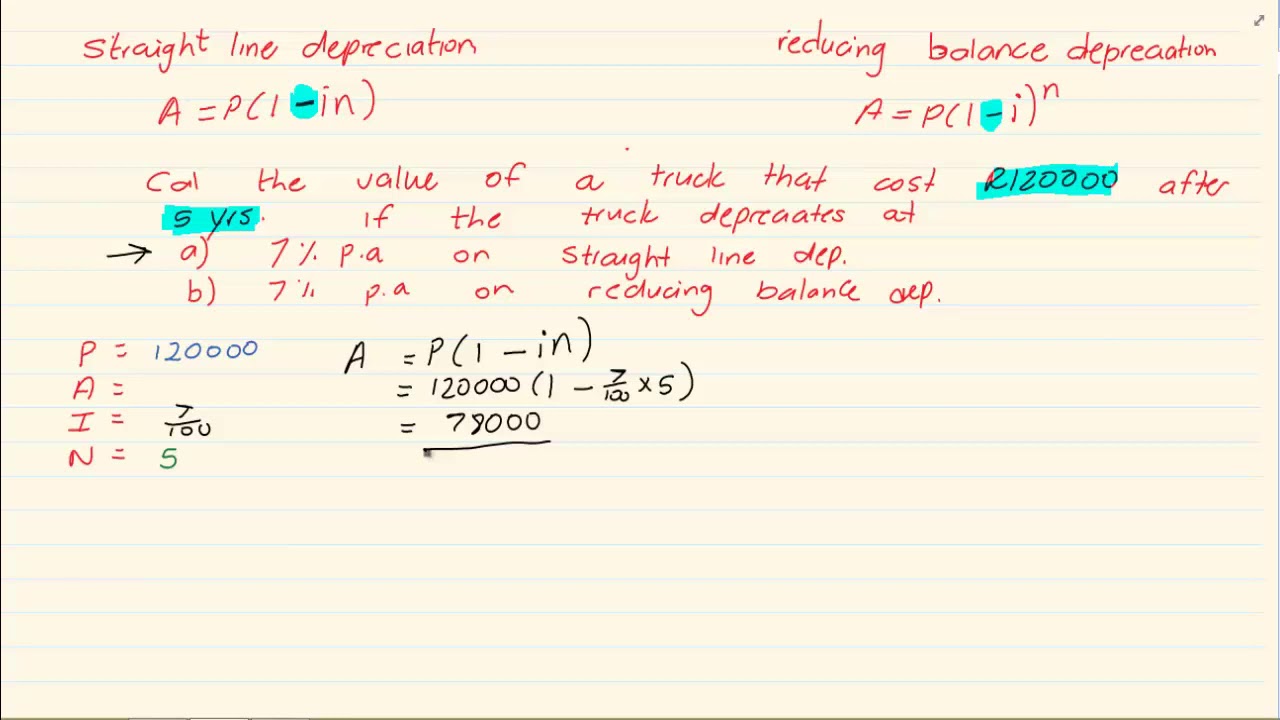

Displaying all worksheets related to - Depreciation Straight Line Method. The DDB rate of depreciation is twice the straight-line method. Straight-line depreciation is a method used to calculate the decline in value of fixed assets such as vehicles or office equipment.

Written Down Value Method. Using the formula for simple decay and the observed pattern in the calculation above we obtain the following formula for compound decay. Depreciation is a measure of how much of an assets value has.

This post will help explain the formula involved in. When Scrap Value is given. Formula for calculating straight line depreciation.

The simplest and most commonly used straight line depreciation is calculated by taking the purchase or acquisition price of an asset subtracted by the salvage value divided by the total. Under this method of charging. Lets discuss each one of them.

You then find the year-one. A P 1 i n. Straight Line Depreciation Method Cost of an Asset Residual ValueUseful.

Since the straight line method utilizes the original cost or the acquiring cost in order to determine the salvage value of any asset in a competitive market the depreciation value of. She has taught math in both elementary. The calculation of depreciation under this method is not much complicatedThe simplicity of the method is also a reason.

Find A Formula For A Function Modeling Linear Depreciation Solve A Linear Equation Youtube

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

1 Free Straight Line Depreciation Calculator Embroker

Annual Depreciation Of A New Car Find The Future Value Youtube

Sum Of Years Digits Depreciation Concept Formulas Solved Problem Pmp Exam Youtube

Depreciation Formula Calculate Depreciation Expense

Math Sc Uitm Kedah Depreciation

Qt 92 Formulas On Appreciation And Depreciation Youtube

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

1 Press Ctrl A C G Dear 2009 Not To Be Sold Free To Use Straight Line Depreciation Stage 6 Year 12 General Mathematics Hsc Ppt Download

Declining Balance Method Of Depreciation Formula Depreciation Guru

2

Method To Get Straight Line Depreciation Formula Bench Accounting

Straight Line Depreciation Youtube

Straight Line Vs Reducing Balance Depreciation Youtube

Straight Line Depreciation Graph Math Finance Flat Rate Depreciation Economics Showme

Grade 11 Financial Maths Depreciation Youtube